Energy Efficient Windows Rebate 2018

If you prefer to have a licensed contractor install your new windows search our directory to find participating contractors.

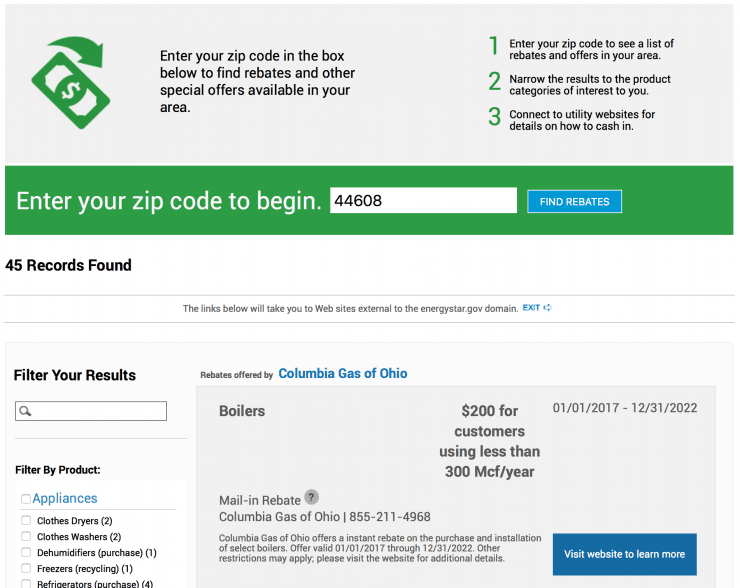

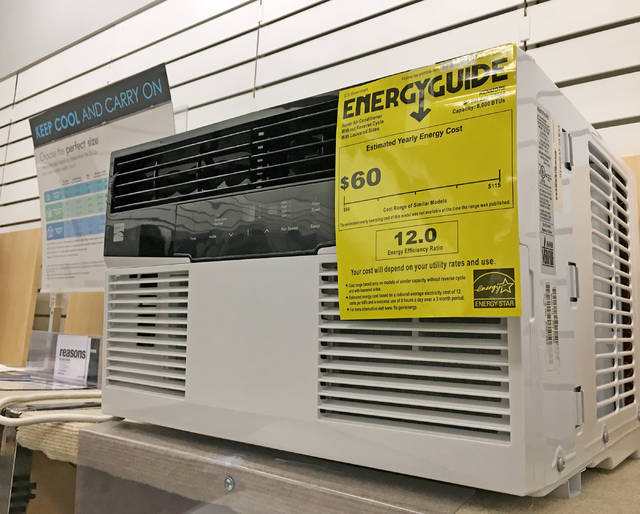

Energy efficient windows rebate 2018. After you install new energy efficient insulation apply for your rebate. The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020. The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021. Find money saving rebates and incentives for your clients.

Through the 2020 tax year the federal government offers the nonbusiness energy property credit. Applications must be received by december 31 2020 to qualify for incentive levels advertised on this rebate chart. Residential home improvement rebate program rebate of 1 60 sf of window for energy star windows. Existing windows must clear glass.

Reflective attic barriers and siding are not eligible. These contractors do not represent or work for dte. Happier clients are better for your business. When upgrading your home to the latest energy efficient appliances and equipment many energy providers offer a variety of rebates for energy efficient products including rebates for washing machines water heaters and smart thermostats.

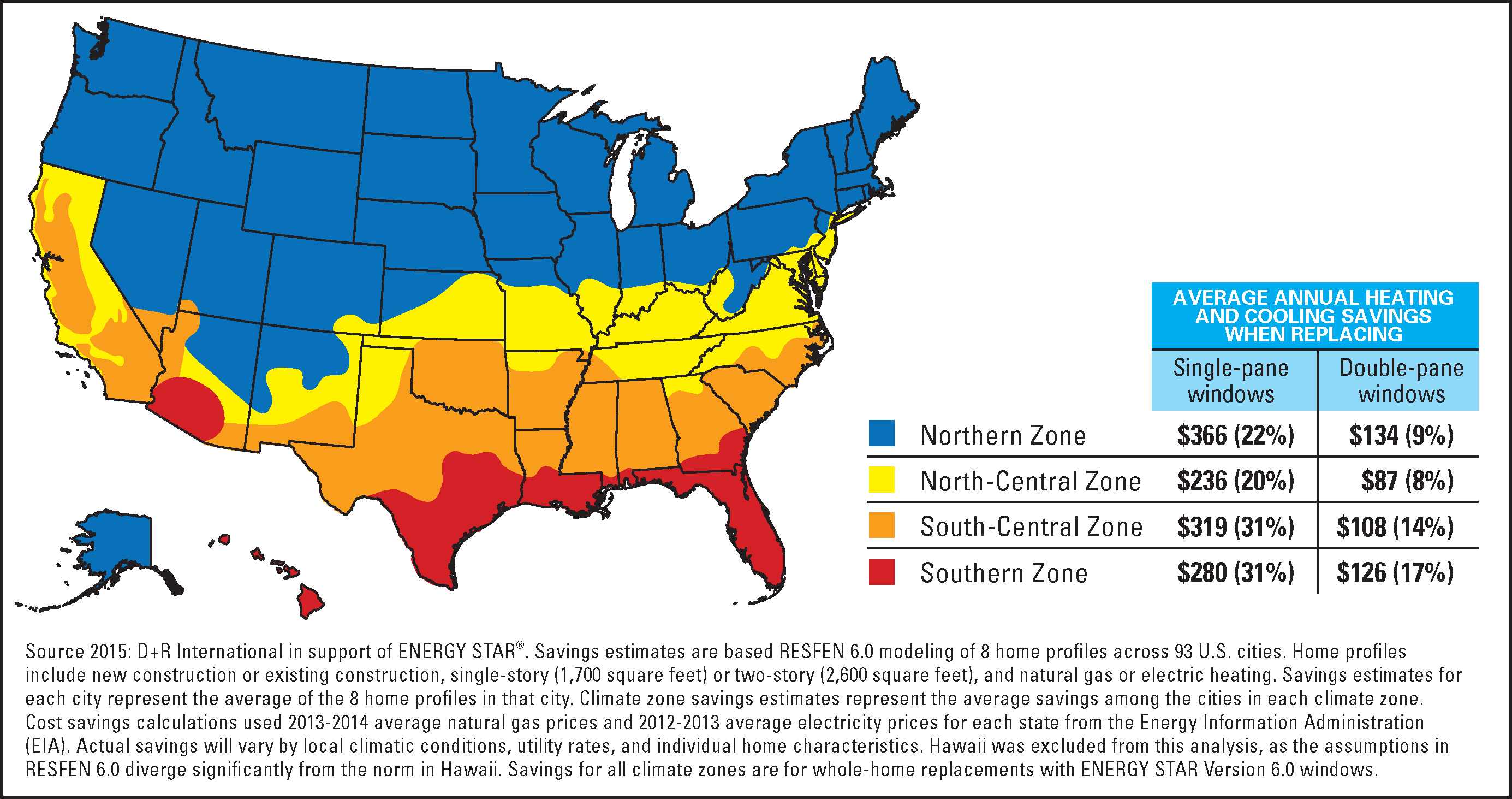

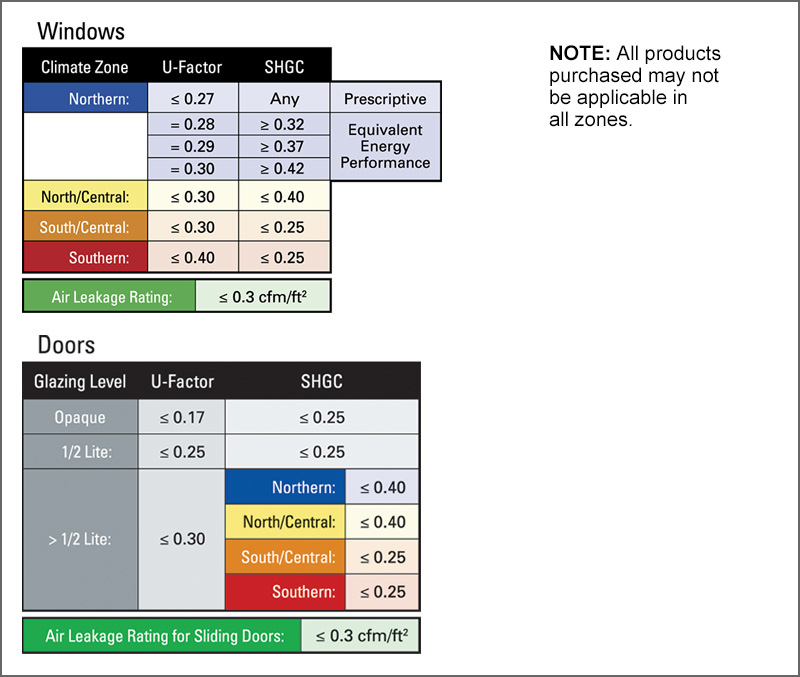

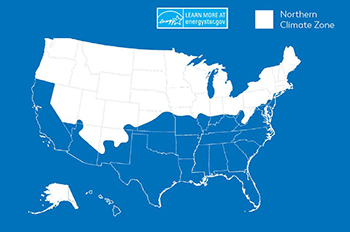

Film must be installed over single or double clear glass and must be located on the east and west elevation. Rebate of 0 40 sf of window film for energy star window film. Some examples may include. Windows are per unit and may include those rated as energy star for northern climate zone.

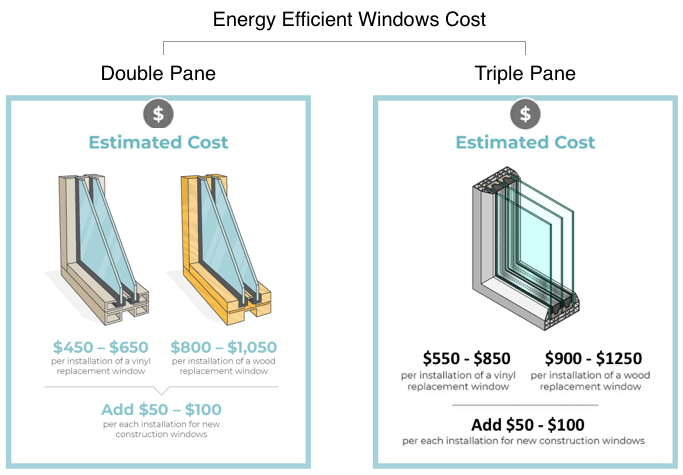

Film must have a shgc of 0 50 or less. Includes sliding and swinging glass doors. Purchase and install qualifying windows or patio doors that meet energy star windows program version 6 0 performance requirements beginning january 1 2018 through december 31 2020 save your sales receipt a copy of the manufacturer s certification statement and product performance nfrc ratings energy star qualification sheet with your. The first part of this credit was worth 10 of the cost of qualified energy saving equipment or items added to a taxpayer s main home in the past year.

For example energy efficient exterior windows and doors certain roofs and added insulation all qualify but costs associated with the installation weren t included. Claim the credits by filing form 5695 with your tax return. 25 50 rebate on energy efficient washers. Here you ll find special offers on heating and cooling systems lighting upgrades energy saving appliances and more.

Federal income tax credits and other incentives for energy efficiency. Help them boost their bottom line with rebates and incentives on the latest energy saving solutions for all types of residential projects. In 2018 and 2019 an individual may claim a credit for 1 10 percent of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500.