Energy Efficient Windows Rebate 2020

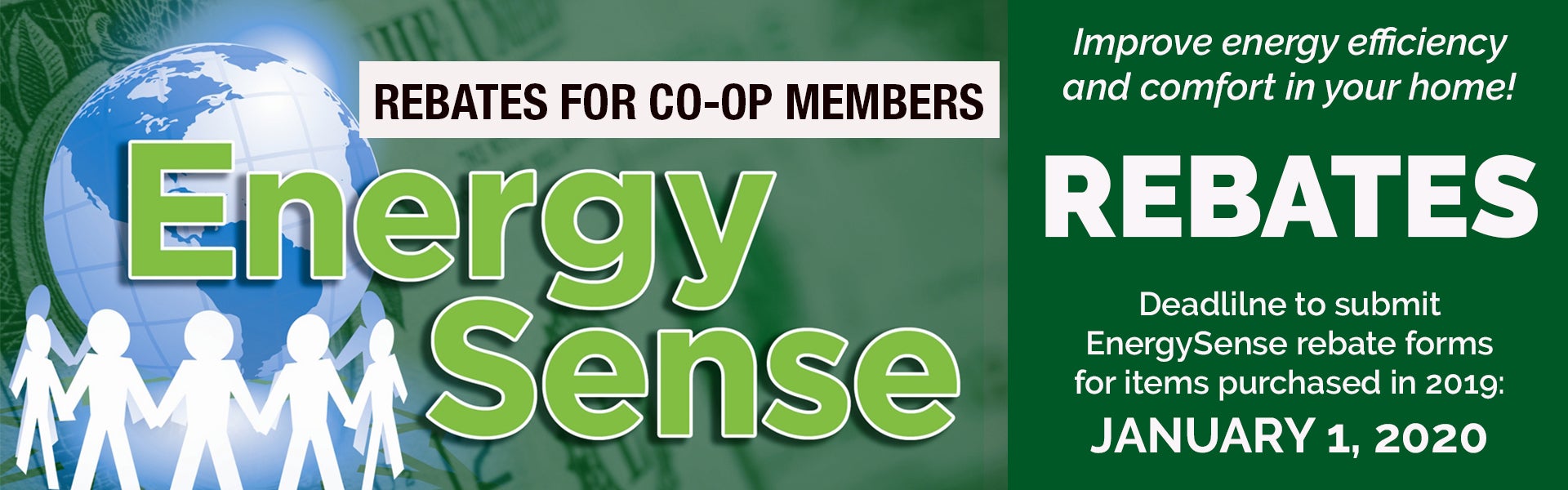

If you purchased and installed a qualifying product in 2018 2020 then you may qualify for this tax credit.

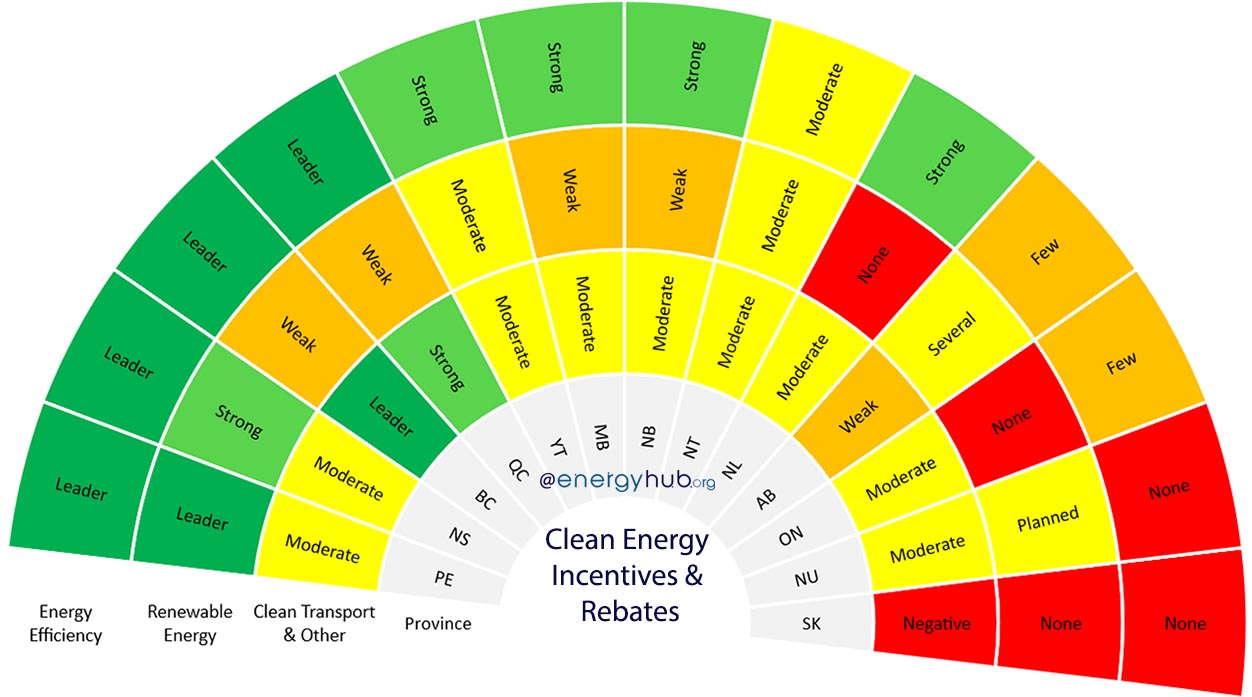

Energy efficient windows rebate 2020. Film must be installed over single or double clear glass and must be located on the east and west elevation. Federal income tax credits and other incentives for energy efficiency. Federal tax credits for certain energy efficient improvements to existing homes have been extended through december 31 2020. Reflective attic barriers and siding are not eligible.

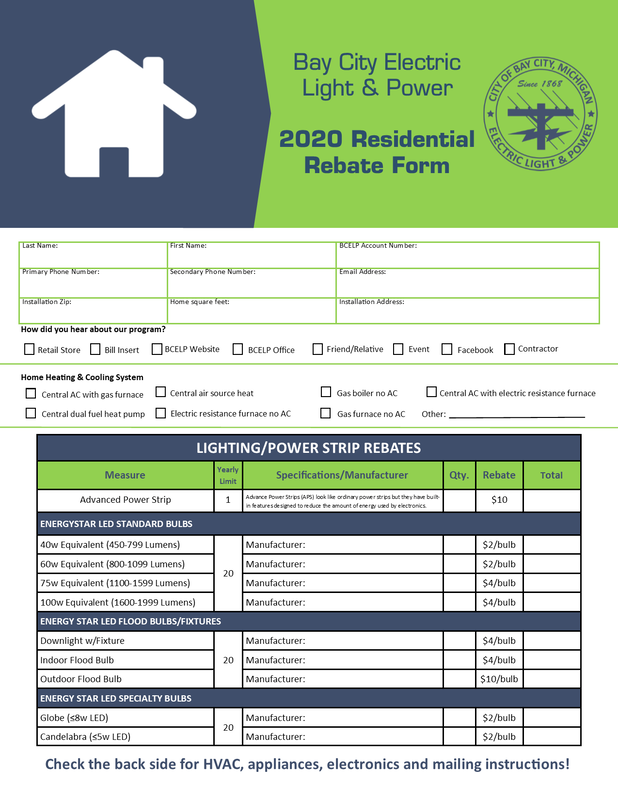

10 of cost up to 500 or a specific amount from 50 300. Epa helping you save energy and money while protecting the environment. Rebate of 0 40 sf of window film for energy star window film. Products that earn the energy star label meet strict energy efficiency specifications set by the u s.

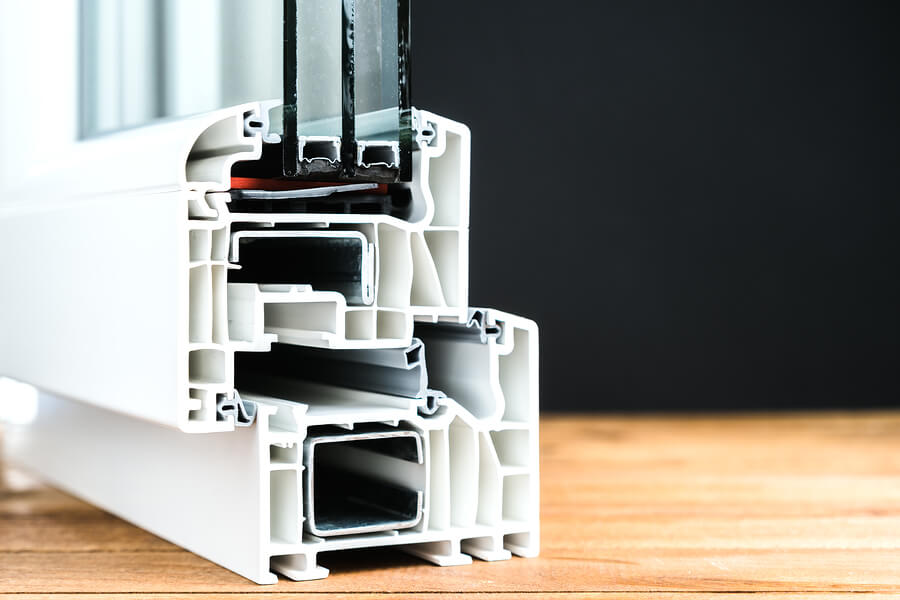

Residential home improvement rebate program rebate of 1 60 sf of window for energy star windows. Applications must be received by december 31 2020 to qualify for incentive levels advertised on this rebate chart. Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020. The non business energy property tax credits have been retroactively extended from 12 31 2017 through 12 31 2020 tax credit.

Includes sliding and swinging glass doors. Windows are per unit and may include those rated as energy star for northern climate zone. The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.